- New corporate bond fund aims to do for capital markets what gender-lens investors did for equity markets

- Targeting capital markets for gender-lens investing could recruit another C-suite ally for gender equality: the CFO charged with raising funding for companies

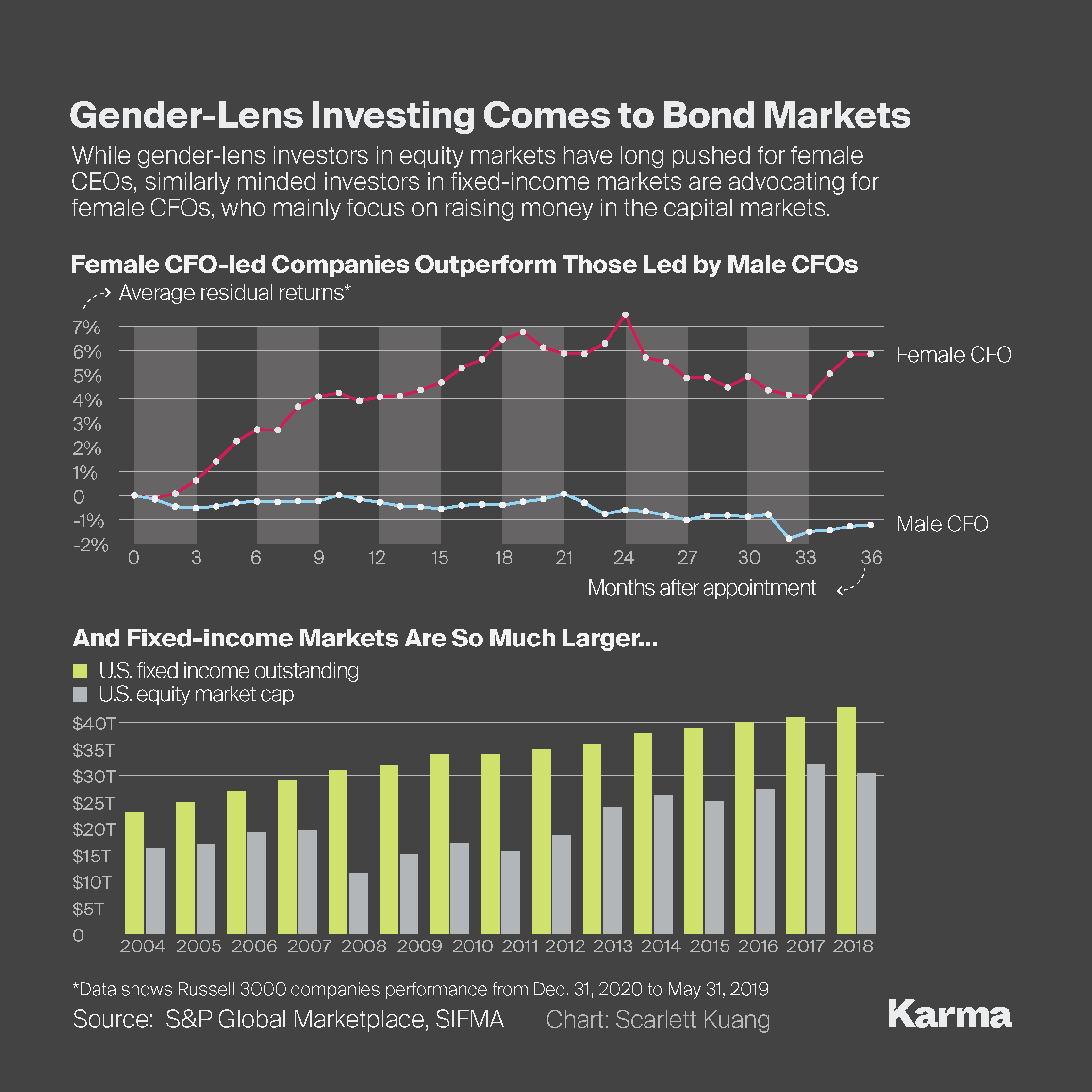

- Fund aims at broader market — there is $103 trillion in fixed-income securities outstanding worldwide, compared with a $75 trillion global equity market cap, according to the 2020 Outlook from SIMFA, the trade organization for the U.S. securities industry

Gender-lens investing isn’t just for equity markets anymore.

Investment management firm Artesian is launching a bond fund to invest in public companies that boost women in the workplace and pledging to give a third of the management fee to charities that work toward women’s economic empowerment.

“There are a lot of gender-lens equity funds, but we found a massive gap in fixed income,” Vicky Lay, Artesian’s head of impact investing and the founder of SheSyndicate, told Karma in an interview. “We wanted to create a scalable way to move capital to gender-lens investing.”

The Artesian Women’s Economic Empowerment Bond Fund — or WE Fund — will invest in public companies that have a commitment to gender equality and women in management and board positions as well as offer fair compensation and work-life-balance policies, according to a statement. It will mostly invest in developed markets because that’s where most gender-lens corporate information and investment-grade bonds are available, Lay said.

Artesian, which has $800 million in assets under management and focuses on debt, venture capital and impact investing, hopes to raise $3 billion to $5 billion for the fund, with $50 million to start. It seeks to generate market-rate returns tracking the Bloomberg Barclays Global Aggregate Corporate Index, according to the statement.

Of the proceeds designated for charity, half will be used to set up a foundation to support nongovernmental organizations that help vulnerable and marginalized women and girls, particularly those affected by the COVID-19 pandemic. The remainder will be split between the United Nations Capital Development Fund, designated to support women’s economic empowerment in the world’s 47 least-developed countries, and SheSyndicate, which uses education, mentoring and outreach to bridge women’s economic gaps.

By targeting the capital markets for gender-lens investing, Lay said she hopes to gain another ally for women in the C-suite: the CFO.

While gender-lens equity investors can “agitate for change” with the CEO because of the top leader’s focus on share price and shareholder returns, the CFO is focused on raising money in the capital markets. So the CFO needs to know that the company might not get sought-after funding if it performs poorly on gender issues, she said.

U.S. capital markets provide 65% of the funding for economic activity, using debt to fuel economic growth, according to the 2020 Outlook from SIMFA, the trade organization for the U.S. securities industry. There are $103 trillion in fixed-income securities outstanding worldwide, compared with a $75 trillion global equity market cap, according to the outlook.

“We want to involve another person in the C-suite,” Lay said. “We want the CFO to feel compelled to have this conversation. We want the CFO also caring about the gender lens and gender equality.”