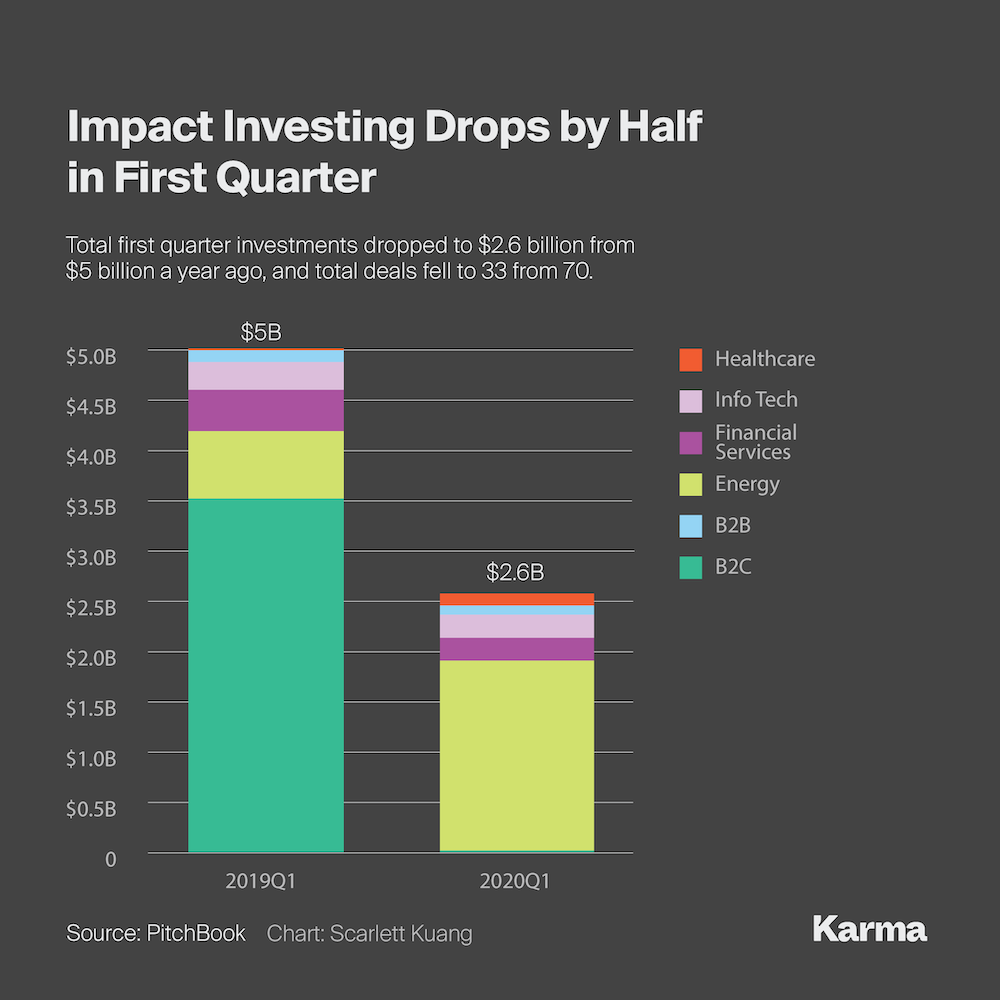

- The number of deals in impact investing was down by about half in the first quarter from a year prior, according to PitchBook.

- Investments plummet on economic retrenching due to pandemic-based recession

- Impact investors who have committed to the strategy are likely to stay the course since ESG-dominant funds frequently beat broader indexes, analysts say.

Impact investing had a brutal first quarter, as the number of deals and the amount invested fell by more than half while businesses prepared for survival amid the coronavirus pandemic.

Total first quarter investments dropped to $2.6 billion from $5 billion a year ago, according to data provided by PitchBook. Total deals fell to 33 from 70. The slide is likely to continue if traditional investors pull back from investments they perceive as riskier as they try to recover lost capital, Indranil Ghosh, founder and CEO of Tiger Hill Capital, told Karma.

“In a crisis, capital tends to retrench to safety. Anything that’s considered fringe, which unfortunately impact still is, tends to lose capital,” Ghosh said.

The retrenchment follows a record-breaking 2019, when Environmental, Social and Governance investments hit $20.6 billion, according to PitchBook’s parent Morningstar. Those investments followed high-profile embraces by global banks like Citigroup and UBS as well as BlackRock, the world’s largest asset manager, the money faucet for the sector has been drying up.

Impact investments, according to PitchBook, include funds that, in addition to investing for financial returns, also invest to intentionally create a positive social or environmental impact and either measure that impact using established standards or self-identify as an impacting fund. Companies that receive investment from nonprofit venture capital firms are also included.

That remains a relatively small market, Ghosh noted, and he said that impact companies have further to go before entering the mainstream. The bulk of the investment in the space is by venture capital firms, and he said they are looking for companies that are scalable and can disrupt mainstream businesses.

“There aren’t that many impact unicorns. At the end of the day, venture capital in particular is about these extraordinary hits,” he said. “There aren’t enough businesses that are going to be the next Impossible Foods.”

Still, Ghosh noted that family offices and individuals with a high net worth that have already made a commitment to game-changing impact projects are unlikely to abandon their strategies just because of the pandemic. It may even strengthen their resolve to seek out impact investments.

There is some indication that impact investors are acting within the crisis to direct funds to companies that are directly working on mitigating the pandemic, Barron’s reports. Other analysts note that remote learning and conferencing platforms and health-tech companies may present investment opportunities even while the market is generally down.

Michael Scanlon, managing director of Marketing and Capital Introduction at Silver Leaf Partners, agrees and remains optimistic about the growing buzz around impact and ESG investments.

“This crisis is not going to take the person who was already concerned about the world and the climate crisis and take them towards oil and gas investments,” Scanlon told Karma.

A recent Bloomberg Intelligence analysis also noted that investors with ESG-heavy portfolios are outperforming index funds so far this year.

Scanlon said he anticipates that to be even more the case after the pandemic. Unlike cyclical or consumerism based businesses that may take a big hit in the recession, he anticipates long-term ESG plays with companies that prioritize the well-being of employees and are driven by values beyond profit to do well.

“Values are going to be a bigger driver moving forward,” he said.

Photo by Andrew Burton/Getty Images