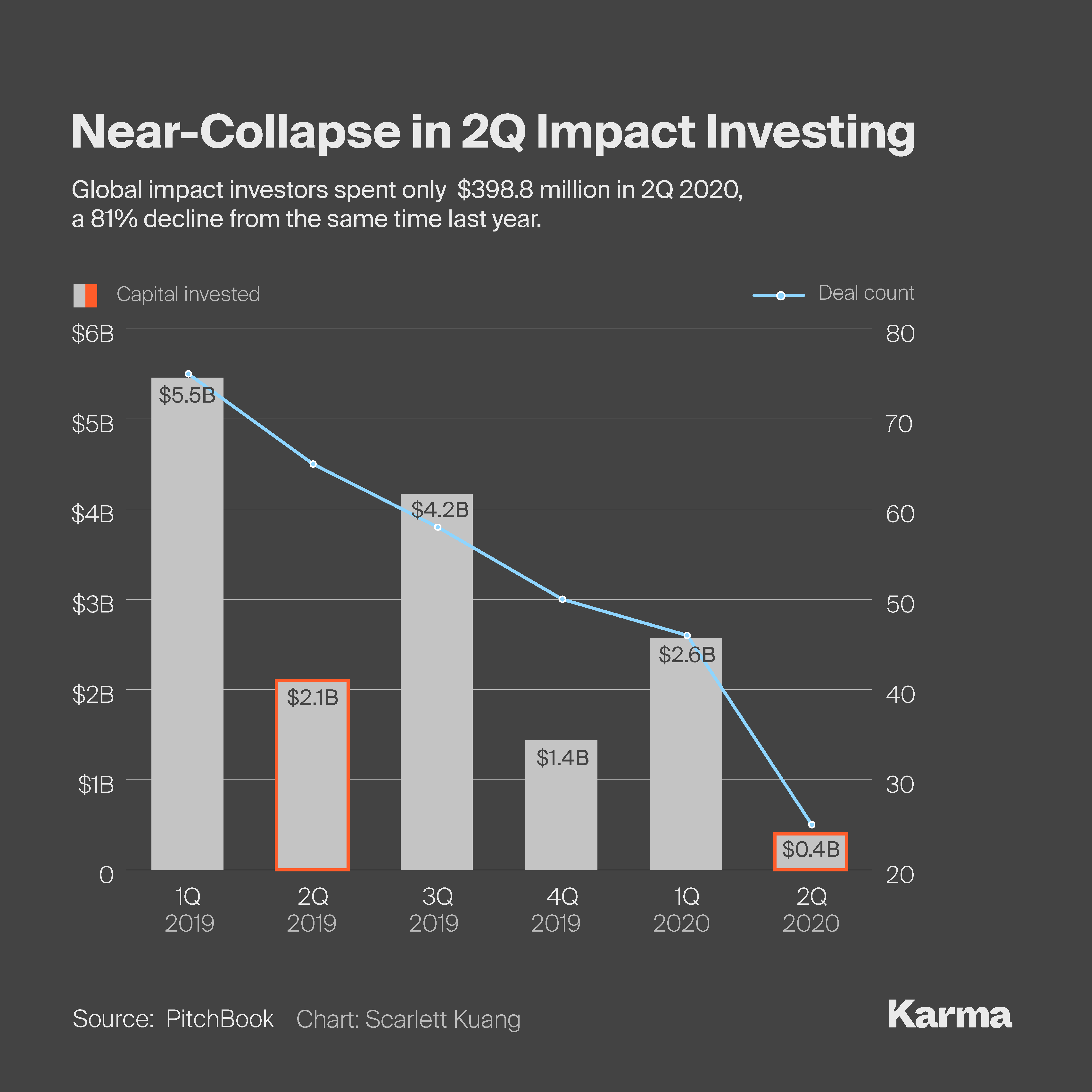

- Capital invested in impact collapsed in the second quarter, falling to $389.8 million from $2.1 billion in last year’s second quarter, according to PitchBook data.

- Coronavirus slows social-impact dealmaking, while social unrest shifts emphasis in ESG investing.

- Social-impact investing may not begin to recover until after investors get a sense of how the pandemic will play out this quarter, Silver Leaf’s Scanlon says.

Impact investing’s decline accelerated in the second quarter, as the twin blows of COVID-19 and social protests hit the sector in different ways.

Total second-quarter investments dropped 81% to $398.8 million from $2.1 billion a year ago, and totaled less than one-sixth of the $2.57 billion first-quarter capital invested, according to PitchBook data. The quarter was the worst in at least a decade, according to PitchBook.

The number of second-quarter deals fell to 25 from 65 a year ago, and slid from 46 in the first quarter. The decline accelerated from the first quarter’s bad news.

“The pandemic was the right uppercut to the jaw,” Michael Scanlon, managing director of Marketing and Capital Introduction at Silver Leaf Partners, told Karma. At the same time, social unrest following George Floyd’s death in Minneapolis police custody added to investors’ concerns about how quickly economies can recover.

“Uncertainty is not a warm feeling,” said Scanlon, predicting investors will “hold back and see what happens in the next quarter with the changes in the pandemic.”

The slow pace of environmental, social and governance investments follows a record $20.6 billion in deals last year, according to PitchBook’s parent Morningstar. The sector had been gaining momentum on Wall Street as BlackRock, the world’s largest asset manager, and global banks, including Citigroup and UBS, embraced ESG investing as necessary to attract younger investors concerned about social impact.

Impact investments, according to PitchBook, are those focused on more than financial returns. They are expected to create positive social or environmental benefits.

Floyd’s death and the nationwide protests against police brutality and racial inequality emphasized the social aspect of ESG investing, Scanlon said.

“The unrest brought the ‘S’ in ESG into play,” he said. “The ‘E’ has always been on the tips of people’s tongues.” Going forward, people are going to be more cognizant of examining the social aspects of an investment, Scanlon added.

The second quarter’s largest deal was in energy — India’s ReNew Power Ventures. The clean energy company raised $142 million in debt financing in the form of a loan from the U.S. International Development Finance Corp., PitchBook said.

The second quarter’s decline followed what had been healthy first-quarter investments in energy. Micro-mobility, while not included in PitchBook’s impact investing category, was a rare bright spot in the quarter — scooter rental company Lime raised $170 million from Uber in May.

“The pandemic reframed the debate on micro-mobility,” Asad Hussain, mobility analyst at PitchBook, told Karma. Investors expect commuters will turn to e-bikes and other smaller vehicles to get to work rather than get on crowded subways and buses, he said.