- An attorney for McDonald’s former chief executive officer Steven Easterbrook pushed back against the fast food company’s lawsuit to clawback his severance payout, following fresh allegations he breached company policy.

- Investors voted against Easterbrook’s large payout at McDonald’s annual shareholder meeting this year, at a time when the company is being criticized for not adequately protecting its workers during the pandemic.

- Some investors say the real problem is ballooning executive pay, which does not incentivize executives to make decisions for long-term company growth.

An attorney for McDonald’s former chief executive officer Steven Easterbrook pushed back against the fast food company’s lawsuit to clawback the executive’s multi-million-dollar compensation, following fresh allegations he breached company policy on dating by engaging in relationships with several employees.

Easterbrook’s attorney Daniel Herr said in a court filing McDonald’s has no standing to clawback his client’s compensation because it had access to all the information regarding his interactions with other employees when the board agreed to his payout, The Wall Street Journal reported.

McDonald’s fired Mr. Easterbrook in November of last year after an investigation found he violated company policy by engaging in a consensual relationship with one employee.

Easterbrook admitted to the breach of conduct for the sole incident at the time and was allowed to walk away with a compensation package that’s estimated to include $675,000 in cash and over $28 million in unvested options.

After new allegations Easterbrook failed to inform the company about his relationships with several other employees, McDonald’s filed a lawsuit in August in Delaware-based court to recoup parts of his compensation.

“McDonald’s stands by its complaint, both the factual assertions and the court in which it was filed,” a company spokesperson told Karma in an emailed interview.

Easterbrook’s attorney did not respond to a request for comment.

Investors including CtW, which represents union pension plans that are shareholders in McDonald’s, voted against Easterbrook’s pay package at the company’s annual shareholder meeting in May.

Investors were critical of the company’s decision to fire Easterbrook without citing a cause, allowing him to exit with the compensation, at a time when the COVID-19 pandemic prompted some McDonald’s employees to protest over unsafe working conditions and raise complaints of sexual harassment at some of the fast food chain’s franchises.

Following the recent developments, investors have continued to call for the ouster of two board members and for the company to strengthen its executive pay clawback policy.

“It’s time for McDonald’s board of directors to set a strong tone at the top, and show shareholders, their customers, employees, and all stakeholders that the company is committed to oversight and accountability,” CtW Executive Director Dieter Waizenegger said in a written statement. “From the very beginning, shareholders objected to the board’s soft-handed approach to investigating allegations about former CEO Steven Easterbrook’s violations…It is now clear that the McDonald’s board’s initial investigation into Easterbrook’s conduct was seriously lacking and will have substantial financial costs as the company attempts to recoup tens of millions paid out for Easterbrook’s exit.”

Some investors say the real problem is ballooning executive pay, which does not incentivize executives to make decisions for long-term company growth and does not create the conditions for continuity in the management ranks.

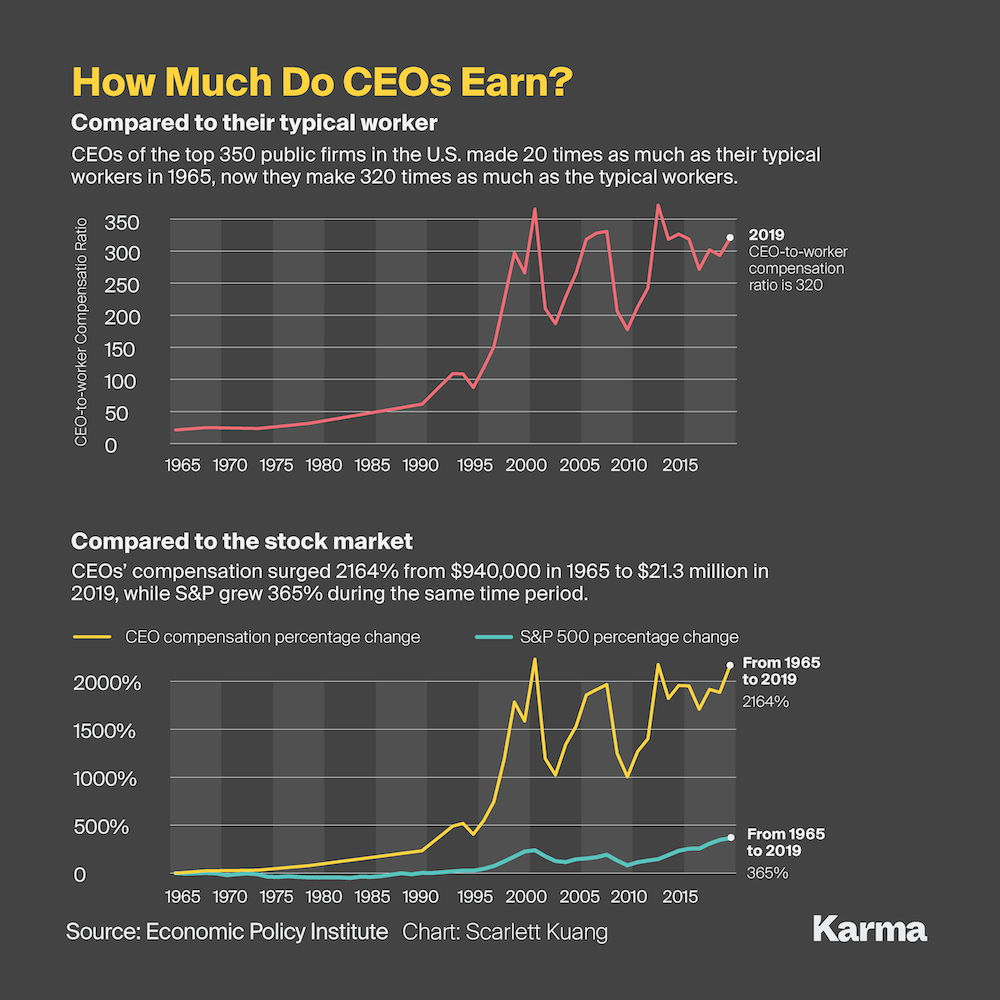

Last year, CEO financial compensation at the top 350 U.S. companies increased by 14% to $21.3 million on average, according to research by the Economic Policy Institute.

More importantly, executive pay is outstripping wages for average workers and is fueling income inequality, says Lawrence Mishel, a distinguished fellow at the Economic Policy Institute.

The top 1% earners in the U.S. saw their income grow by 157.8% from 1979 until 2018

compared to the bottom 90% of workers that had annual salaries rise by 23.9% in the same time period, according to Mishel.

“While wage growth for the majority of Americans has remained relatively stagnant for decades, CEO compensation continues to balloon. Executive pay is driving inequality,” Mishel told Karma.

Photo by Stephen Maturen/Getty Images