Mexican challenger bank Albo nabbed an investment from Paypal co-founder Peter Thiel, in the latest indication that the government’s push for financial inclusion places Mexico among the most attractive locations in Latin America for fintech investors.

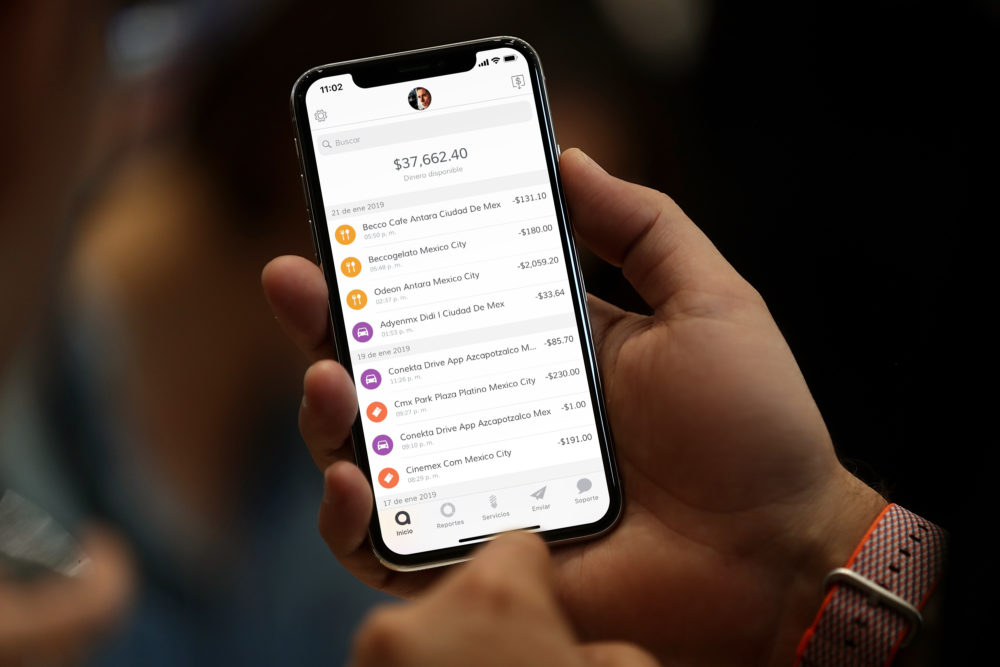

Albo offers online banking services to the country’s large unbanked population, and permits customers to open an account online within minutes and get a prepaid Mastercard tied to a phone app. The company’s second round, $18 million funding was led by Thiel’s VC firm Valar Ventures. The deal brought Mexico City-based Albo’s total raised to $26.1 million.

Mexico began a series of efforts in 2015 aimed at giving the country’s unbanked population access to financial services. Last year the government passed legislation aimed at regulating and promoting fintech, and in October rolled out a smartphone payment system called CoDi that covers everyday payments such as hospital bills and metro rides.

Even so, 44% of adult Mexicans lack a bank account, according to the latest available data from Encuesta Nacional de Inclusion Financiera, and fintech investors see plenty of opportunities. Venture capital investments in Mexico’s fintech space surged to $163.7 million this year, more than sixfold from 2018. For two consecutive years, Mexico has attracted more than Latin America’s biggest economy, Brazil, which raised only $43.8 million this year, according to PitchBook data.

“We want to make Albo the company where anyone can solve any financial need they had, and for this we must offer more financial products in addition to the current,” Ángel Sahagún, Albo’s founder and CEO, said in an interview with FinTecBuzz earlier this year.

- Albo differentiates itself from other challenger banks with zero fees and an easy-to-use phone application, Sahagun says.

- Mexico’s fintech scene is ripe with competition. Softbank-backed microfinance startup Konfio scored $100 million in December, the largest finch deal in the country this year, according to PitchBook data. Tencent-backed digital bank Nubank from Brazil opened an office in Mexico last May.

- The most active fintech investor in Mexico are Argentina’s Kaszek Ventures and Mexico City-based Jaguar Ventures, which both invested in four deals in the last five years including financial service platform Konfio.