- Total energy consumption has plunged because of COVID-19, but renewables are the one area that will continue to grow.

- Clean energy isn’t just good for the environment, it’s also a good investment because the electricity produced is almost free once the initial outlay is made.

- Government policies will determine the pace of clean energy growth once the pandemic eases, and whether the drop in greenhouse-gas emissions will continue.

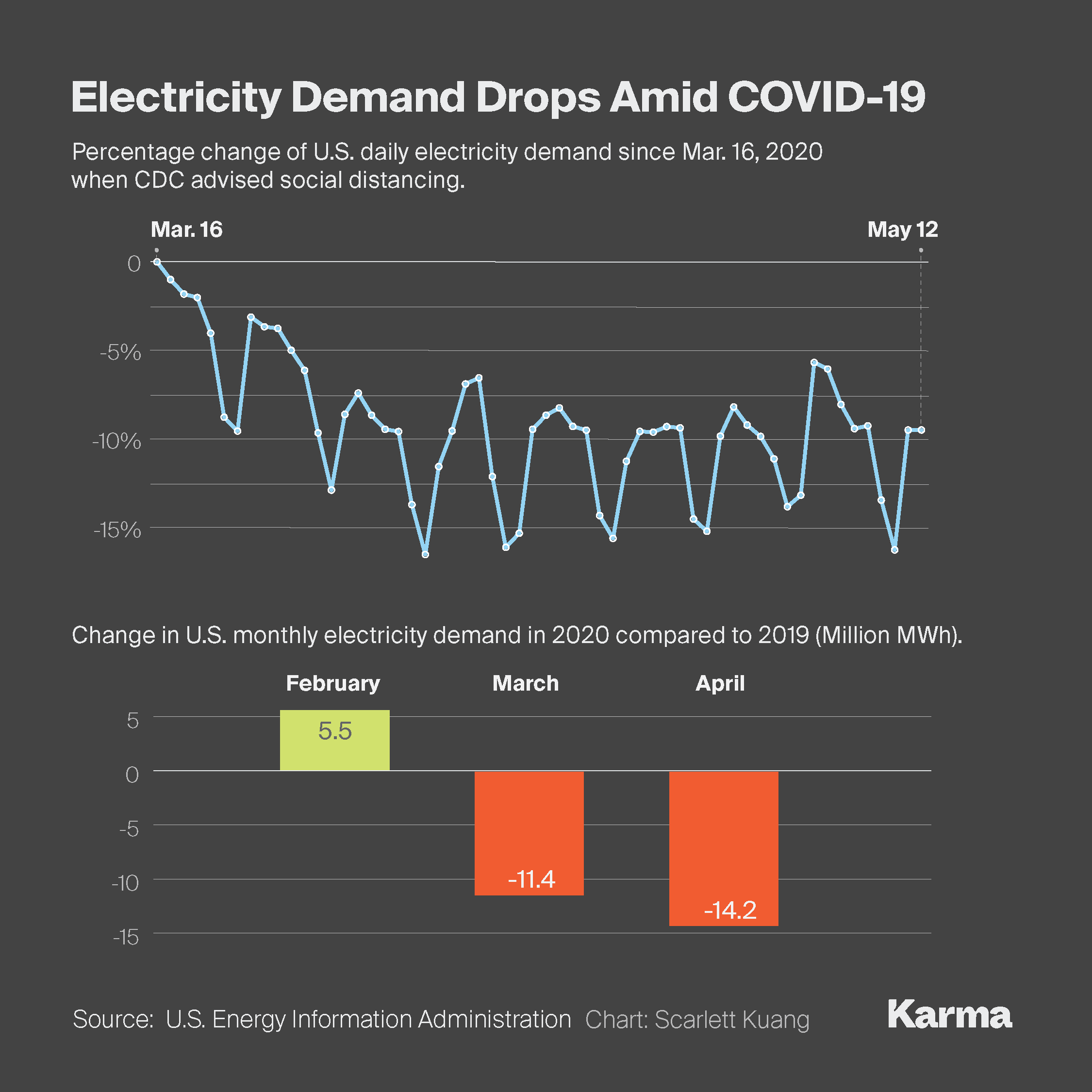

Energy demand has plunged because COVID-19, but renewables continue to increase their share of global power output even as fossil-fuel prices have tumbled.

Global electricity demand is projected to fall 5% in 2020, but renewable power generation is seen rising 5%, according to the International Energy Agency. Wind, solar and hydroelectric projects that came online in 2019 and the first months of this year will continue humming, curbing the need for coal and natural gas. Once the initial investment is made, renewable energy is practically free, beating out fossil fuels, even after they’ve fallen to the lowest levels seen in decades.

“Renewable energy resources are quickly becoming the lowest-cost source of electricity globally, so it is not surprising at all that they continue to be an attractive option,” Rachel Cleetus, climate and energy program policy director for the Union of Concerned Scientists, told Karma.”That said, there are definitely some challenges ahead and we should not take this trend for granted.”

A 6% decline in total energy consumption this year will have one silver lining, greenhouse gas emissions are seen dropping 8%, according to the IEA, which helps governments set energy policy. The International Renewable Energy Association has called for COVID-19 recovery efforts to be in line with the Paris Climate Accord so that the decline in carbon emissions won’t end when the economy comes back.

“The downturn in electricity consumption caused by the coronavirus pandemic is accelerating the retirement of coal plants and making space for more rapid growth in renewables,” Ted Nace, executive director of Global Energy Monitor, told Karma. “The reason is that the marginal cost of renewables is zero.”

Global coal demand is expected to drop by 8% this year, the largest decline since World War II, according to the IEA. American coal consumption fell 16% in 2019 to the lowest level since 1976, according to the U.S. Energy Information Administration. Demand is expected to decline an additional 23% this year, the agency said.

“Coal’s market share in April dipped to just 15%, a radical drop for the fuel that made up over 50% of U.S. energy consumption only a decade ago,” Nace said.

Energy investors who took ESG criteria into consideration and avoided fossil fuels are benefiting now. Fossil fuel companies have hemorrhaged cash as prices tumbled this year. Clean energy companies and ETFs have performed much better. The Invesco Solar ETF TAN has climbed about 12% since May 1.

European leaders seem to be paying attention to these pleas. European Commission President Ursula von der Leyen said on April 28 that the European Green Deal will be “our motor for the recovery.” The same day, German Chancellor Angela Merkel said that economic stimulus will be accompanied by a “close eye on climate protection.”

However, Republicans in the U.S. are warning that the adoption of green policies will lead to further economic pain. In a move that will cheer clean-energy advocates, the Treasury Department indicated last week that it will move to allow wind projects to fully benefit from federal tax credits in response to a letter from a bipartisan group of senators.

“As governments make decisions about investments to help with economic recovery, boosting clean energy is a clear win for public health, for jobs and the economy, and will also help address the climate crisis,” Cleetus said.

Photo by Dean Mouhtaropoulos/Getty Images