- U.S. investors have turned up the heat on companies with a record number of ESG shareholder resolutions this year and the COVID-19 pandemic may spur even more proposals next year.

- Sixteen investor petitions concerning ESG matters have gotten more than half of shareholder votes at various companies’ annual meetings in 2020, up from 14 last year, says Morningstar.

- Still, American investors say they are fighting an uphill battle in a regulatory climate that has turned increasingly hostile toward shareholder actions.

For impact investors looking to shake up corporate America, 2020 has already been a barnburner year. Shareholders filed and passed a record number of resolutions on environmental, social and governance matters, and expectations are for an even hotter 2021.

Financial institutions are already warning corporate clients that investors — many inspired by problems exacerbated by the COVID-19 pandemic — are even more likely to use shareholder proposals to battle climate change, inequities and social justice matters.

“Unless companies voluntarily start changing the way they behave and the way that they disclose information and how they plan for the future, I think many would agree that resolutions are going to become more frequent and more ambitious as time goes by, especially as it’s seen as a way to be able to get incremental change,” says April Williamson, an environmental lawyer for the U.K.-based nonprofit Client Earth, which supported investors file climate-related resolutions this year at the French oil giant Total SA.

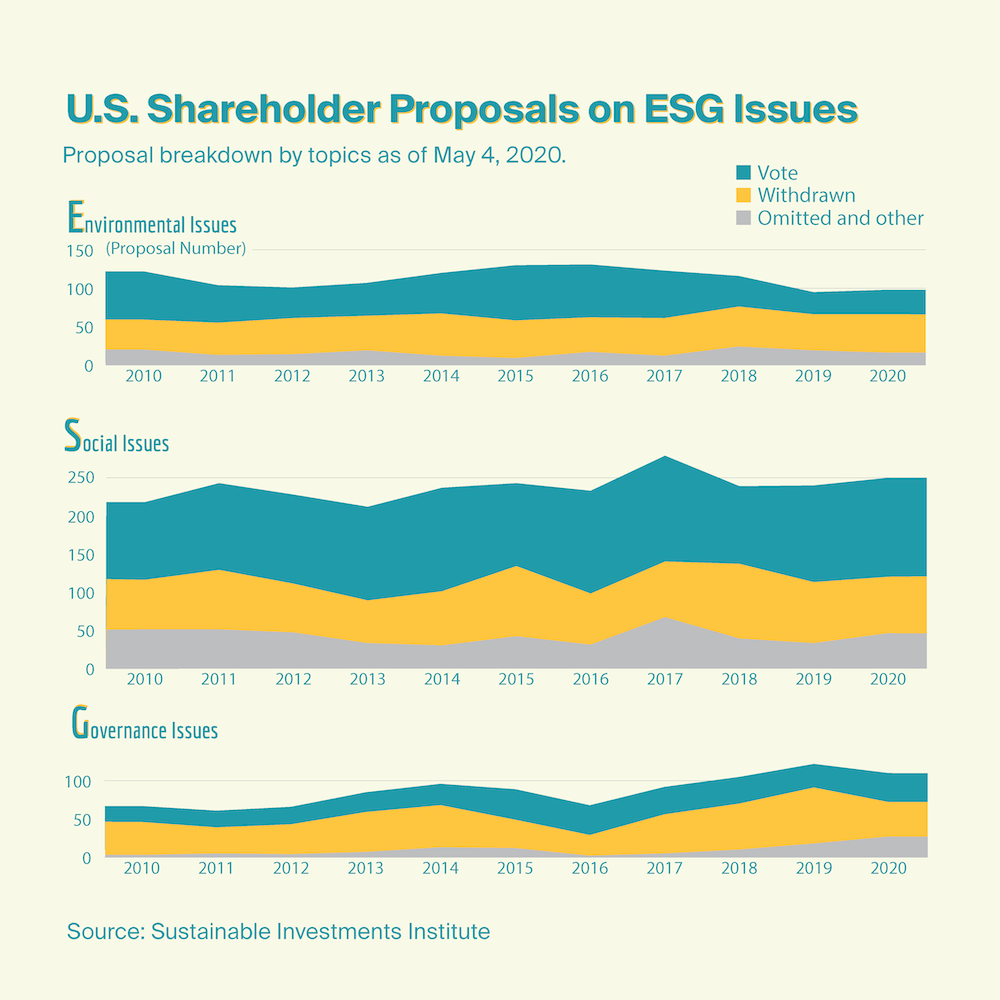

Though shareholder proposals have been a tool for change since the Civil Rights Era, in recent years, they have gained new momentum. In 2020 so far, 16 investor petitions concerning ESG matters have gotten more than half of shareholder votes at various companies’ annual meetings, up from 14 last year, says Morningstar.

“We’re seeing more, higher votes, particularly on climate resolutions because there’s a recognition by the investors that these issues are becoming sharp risks to companies,“ Kirsten Spalding, the senior director of the investor network for CERES, whose members hold about $29 trillion in assets, told Karma. “If a company doesn’t have a robust plan, it’s not going to survive in the lower-carbon economy that’s coming.”

Overall, U.S. investors filed about 429 such resolutions for the 2020 proxy season, an uptick from 366 last year, according to As You Sow, a Berkeley, Calif.-based nonprofit that partners with investors to file shareholder resolutions.

Andrew Behar, the organization’s chief executive officer says the numbers aren’t as important as the engagement with companies. “There is no such thing as pass or fail — there is just a number that represents shareholder support,” he said. “We only count a win when a company changes its policies and practices.”

[ Read: Karma’s brief how-to guide on shareholder proposals ]

When the organization got 11% of shareholders to vote in favor of a climate change-related resolution at Sanderson Farms, the agricultural company agreed to implement As You Sow’s proposal in full. In contrast, it got 79% of shareholders to vote in favor of a pay-equity disclosure proposal at car parts company Genuine Parts, but investors aren’t sure the company will comply with the resolution.

“We count Sanderson as a win and Genuine as a work-in-progress,” said Behar.

Headwinds in the U.S.

The wins are especially hard-fought in the U.S. since most shareholder resolutions are non-binding. If a proposal gets a majority of votes at an annual meeting and a company fails to act on the resolution, U.S. shareholders can seek to hold the company responsible by pushing for the removal of board members and nominating new directors.

In contrast, U.K. investors can take non-compliant companies to court because investors often pursue so-called special resolutions, which are legally binding. These resolutions need to garner 75% of the vote.

Investors worldwide are writing more proposals and ramping-up pressure on companies amid a growing push to use the financial system and commercial activities to address societal ills, driven in part by the United Nations’ 17 sustainable development goals, a roadmap created by the international body to tackle future challenges such as climate change and global poverty reduction by the year 2030.

However, U.S. investors operate in an environment with more headwinds than their counterparts across the Atlantic, say experts. U.S. companies frequently reject investor proposals they say are too numerous and costly to review and do not fall within the purview of their specific commercial activities.

The Securities and Exchange Commission is currently reviewing a proposal that would make it more difficult for investors to influence corporate behavior. The rule would boost the value of stocks an investor needs to hold in a company to file shareholder proposals to $25,000, up from the current level of $2,000. The agency has also proposed to increase the level of shareholder support a resolution needs to garner in order for it to be resubmitted for consideration in subsequent years.

Asset managers in the U.S. are looking for signs that the SEC is watching how they measure ESG factors and may crack down on the sector. Representatives for the commission have raised concerns the ESG sector has no uniform accounting standard and therefore issues guidance that may be misleading for investors. The SEC sent out queries to several asset managers asking them to disclose their standards and metrics in late 2019, according to a source familiar with the matter.

Progress in Europe

Though European investors face higher stock-holding thresholds for filing resolutions than American investors and therefore file a lower number of proposals, European companies are more inclined to engage in dialogue with investors and are less likely to reject proposals on ESG matters.

A group of over 5,000 shareholders, working under the umbrella of the Netherlands-based group Follow This, in the last five years have urged energy companies such as Royal Dutch Shell PLC, BP, and Exxon Mobil, the world’s largest publicly traded oil and gas company, to set up carbon-emissions-reduction targets in line with the 2015 Paris Climate Accord.

The engagement with all the companies has been good, but the group has had more success getting resolutions passed with Europe-based energy companies than their North American peers, says Mark van Baal, a Follow This founder.

Follow This submitted nearly identical climate change resolutions at several oil majors this year asking them to quantify and reduce emissions for all aspects of their operations — including the greenhouse gases generated by consumers that use their products, sometimes referred to as “Scope 3” emissions.

U.S.-based Exxon and Chevron Mobil successfully blocked and prevented the proposals from being voted upon at their annual shareholder meetings, while the proposals were voted on and received significant support from shareholders at the Anglo-Dutch company Shell, Norway’s Equinor ASA and France’s Total S.A.

“They actually don’t like shareholder democracy — and the U.S. oil companies don’t like it as much as the Europeans don’t like it,” van Baal told Karma. “The only key difference is that in Europe, they can’t block resolutions. But this won’t go away because investors realize that we are at the 11th hour to do something about it and that they really want action instead of vague promises.”

Building ‘A Better World’

James McRitchie says the climate for shareholder activism has always been tough and that the ESG matters many fight for today have always been important.

A veteran activist investor who has been filing shareholder actions for over two decades, McRitchie has been personally sued in regular court by companies seeking to exclude his proposals from their annual meetings.

He says the regulatory climate has toughened over the years.

“It’s very much a hostile environment,” McRitchie told Karma. “The SEC was created in order to protect shareholders. It was not created to protect management from shareholders. It’s become worse under the Trump administration. It’s become more and more difficult to file proposals.”

He says the commission pays more attention to the business community, which has more time and money to lobby regulators than retail investors.

McRitchie says investors concerned with ESG issues need to step up their game in vetting offerings by large asset managers and should ask regulators to require such companies to clearly disclose their ESG voting record.

“There’s a lot of greenwashing out there,” McRitchie told Karma. “People want to invest in good things. They want their children to live in a better world than the one we have today. … They want to do away with racism, sexism, environmental pollution and then they put their money in funds that are still voting against all the [ESG] proposals.”