- In spite of the large tonnage of medical waste generated by the pandemic, landfill volumes have fallen.

- Virtually no new landfills are being built now. In fact, some facilities are shutting down and companies are laying off workers, according to a recent survey of landfill operators.

- Worldwide, more than 2 million people have been confirmed to have COVID-19, and over 140,000 have died. The numbers have spiked in the U.S., with more than 657,000 confirmed cases and over 35,000 deaths.

Landfill usage is poised to decline as states battle the COVID-19 pandemic, in spite of an uptick in medical waste caused by the disposal of tons of soiled personal protective equipment (PPE) used in treating coronavirus patients.

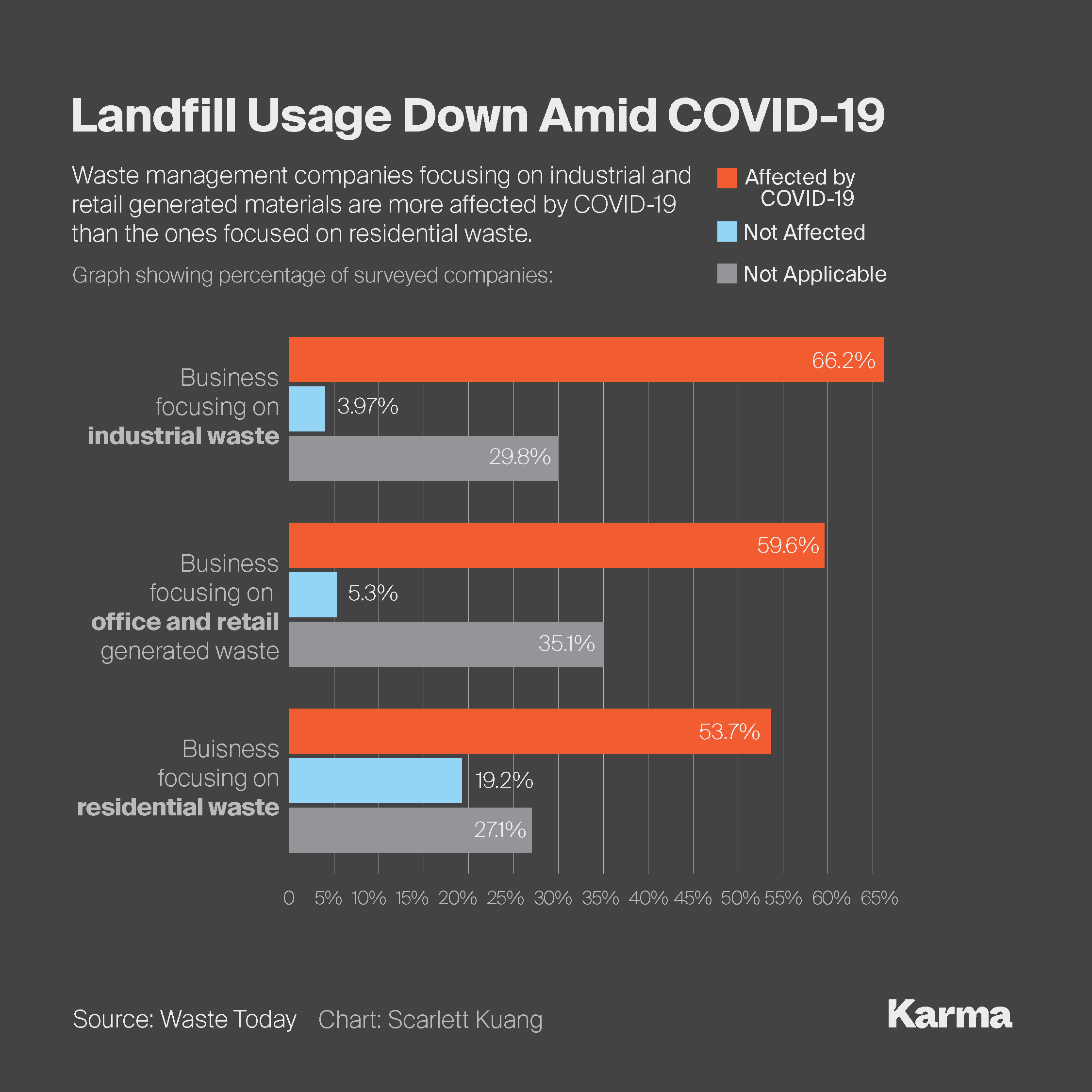

Aside from landfills handling medical waste, volume has dropped since mid-March when the pandemic took hold in the U.S. and stay-at-home orders and social distancing guidelines were issued, according to a recent survey from the magazine Waste Today. Inbound materials from offices and retail operations have fallen by more than half, with a quarter of landfills reporting they were “severely affected” and another quarter saying they were “moderately affected.” About a third of respondents reported that one or more of their facilities have closed, due either to a state order or management decision.

Worldwide, more than 2 million people have been confirmed to have COVID-19 and over 140,000 have died. The numbers have spiked in the U.S., with more than 657,000 confirmed cases and over 35,000 deaths.

Companies like Stericycle, the largest hauler of regulated medical waste in the U.S. and operator of 50 medical treatment plants, handle the disposal of material generated in fighting the disease. It sends inbound materials — including soiled gowns and masks and what are called sharps, needles and scalpels — to special sanitary landfills after burning or sterilizing them. The publicly traded, Illinois-based company neither owns landfills, as do the major players in waste management, such as Waste Management Inc. and Republic Services Inc., nor recycles equipment.

“We are seeing some increase in medical waste generated due to heightened use of personal protective equipment in the diagnosis and treating COVID-19 patients, and some nontraditional solid waste is likely being over-classified as regulated medical waste,” Selin Hoboy, Stericycle’s vice president, government affairs and compliance, told Karma. “However, these increases are being offset by declines in medical waste from noncritical or elective surgeries and the temporary closures of smaller healthcare practices.”

Unlike regular waste, such as food products, containers and cardboard, medical waste, which can include human blood and other bodily fluids or other grossly contaminated PPE, is regulated by the Occupational Safety and Health Administration (OSHA) for handling and the Department of Transportation (DOT) for transportation and by the individual states for management and treatment before disposal. Typically, states require that regulated medical waste be separated from everyday solid waste and that it undergo a treatment to render it noninfectious before disposal.

The drop in landfill usage may have an upside for some investors, according to David Biderman, executive director and CEO of the Solid Waste Association of North America (SWANA).

“To the extent that we can reduce, reuse and recycle more material, it preserves valuable airspace in landfills for future generations. Since landfill tip fees typically rise over time, and we aren’t building hardly any new landfills in the U.S., this can enhance the value of existing landfills — and makes them an increasingly valuable asset,” Biderman told Karma.

Fees usually go up in line with inflation, added Biderman, but in 2018 and 2019 they rose even more because of the healthy economy and the brisker pace of consolidation within the industry.

One hazardous waste transporter that services healthcare facilities told Waste Today anonymously that it’s seeing “an uptick in business and revenues.” However, the industry’s overall downturn will likely hurt waste-management workers the most. According to the survey, “19.87% of businesses say layoffs have occurred, 22.52% say layoffs are being considered, 2.65% say they are adding staff, and 54.97% say no change in personnel levels is anticipated.”

Photo by John Moore/Getty Images