- AXA’s latest climate report lays out financial losses caused by floods, storms and extreme temperatures, and discusses costs of transitioning to greener technologies.

- Investors are on track to lose millions as the causes of climate change wreak havoc on the planet.

- Increased exposure to warming-induced severe weather caused losses in the past decade, according to the report.

Talk of climate change often ignores the reality that multimillion-dollar losses come with floods, wind and hail storms, temperature extremes and other natural catastrophes.

French insurance giant AXA squarely lays out the dire fiscal consequences of disregarding climate change — an average annual loss of $5.1 million due to floods, an average yearly hit of $7.3 million because of windstorms — in its latest report AXA 2020: Renewed Action in the Time of Crisis.”

It pointed out that the transition to lower carbon emissions “will likely create economic losses in the form of ‘regulation costs’ for those who fail to adequately adapt.”

“Transition risks may pose varying levels of financial and reputational risk to organizations,” the report states using language borrowed from the Taskforce on Climate-Related Financial Disclosures (TCFD). “Transitioning to a lower-carbon economy may entail extensive policy, legal, technology, and market changes.”

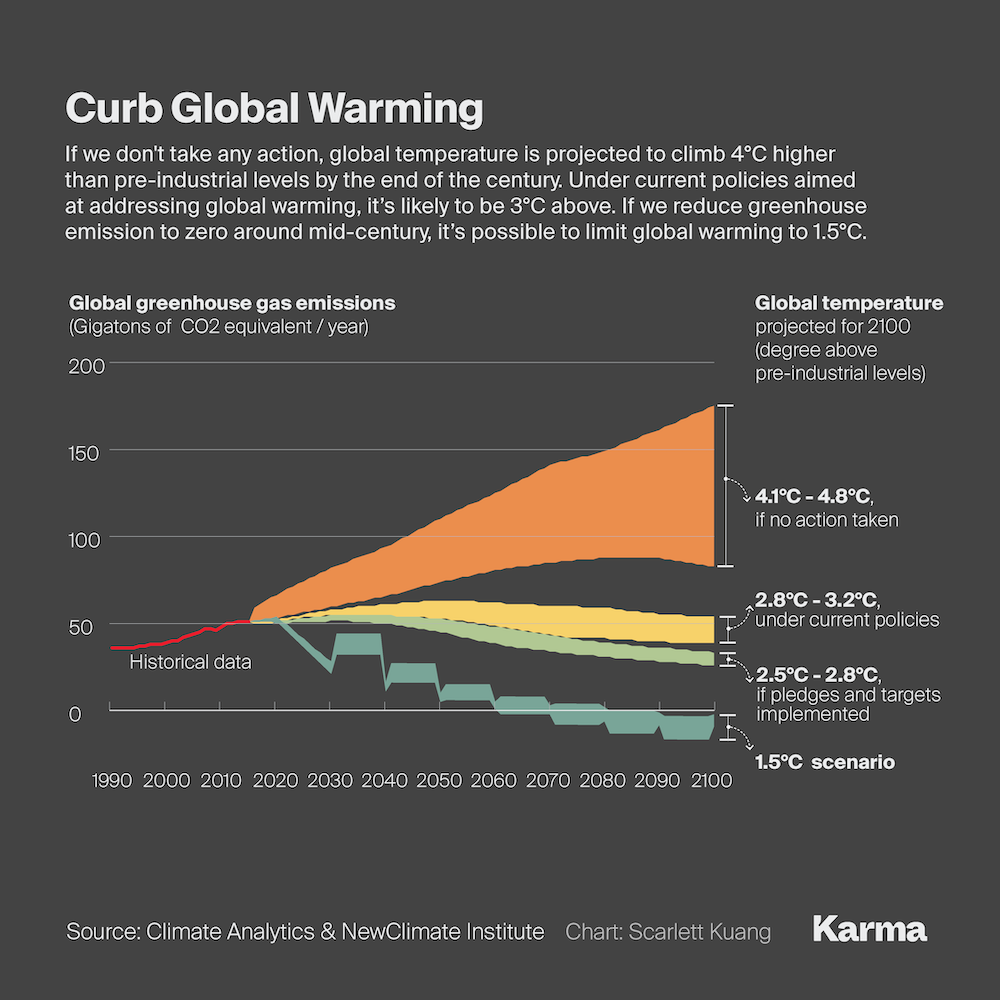

The insurer is aligned with goals of the Paris Climate Agreement, which set a global framework to avoid dangerous climate change by limiting global warming in the near term to 2°C, with a longer-term plan of reaching 1.5°C. Nearly 200 nations, including the U.S., signed the Paris accord, which took effect in November 2016. In December, the U.S. pulled out of the agreement.

AXA’s report satisfies a legal obligation under the French law on energy transition for green and ecological growth and the approach of the TCFD that the insurer has supported since its creation. It offers data, reasoning behind AXA’s investment decisions, risk assessment related to natural disasters and where 13 select countries rank on the climate change scale related to the Paris accord.

In short, Sweden and France are the most progressive, while Canada, the U.S. and Australia have the most to do on climate change.

AXA and the industry as a whole have a ways to go. “The fact that AXA’s warming potential is 2.8°C at the end of 2019 and 3.6°C for the industry shows that substantial efforts are still needed from all economic players to limit the warming potential to +1.5°C by 2050, in line with the objectives of the Paris agreement,” Celine Soubranne, AXA’s chief corporate responsibility officer, told Karma in an email.

Yet, the report turns up positive nuggets. “The good news is that AXA’s warming potential is declining,” Soubranne wrote. “This evolution notably reflects the ambitious policy implemented by AXA to align its investments with the objectives of the Paris agreement by 2050 (24 billion in green investments, total exit from the coal industry, financing the energy transition and more.)

The report also addressed how environmental, social and governance concerns are a core part of “responsible investing.” “AXA Group has made ESG a cornerstone in its investment strategy, thanks to a complete integration of ESG considerations into its qualitative credit assessment and investment since 2015,” wrote the authors. Last year, AXA IM’s credit research team adopted a similar approach.

The warming potential for AXA’s industry is 3.6°C at the end of 2019. An earlier version of this story incorrectly said 3°C.