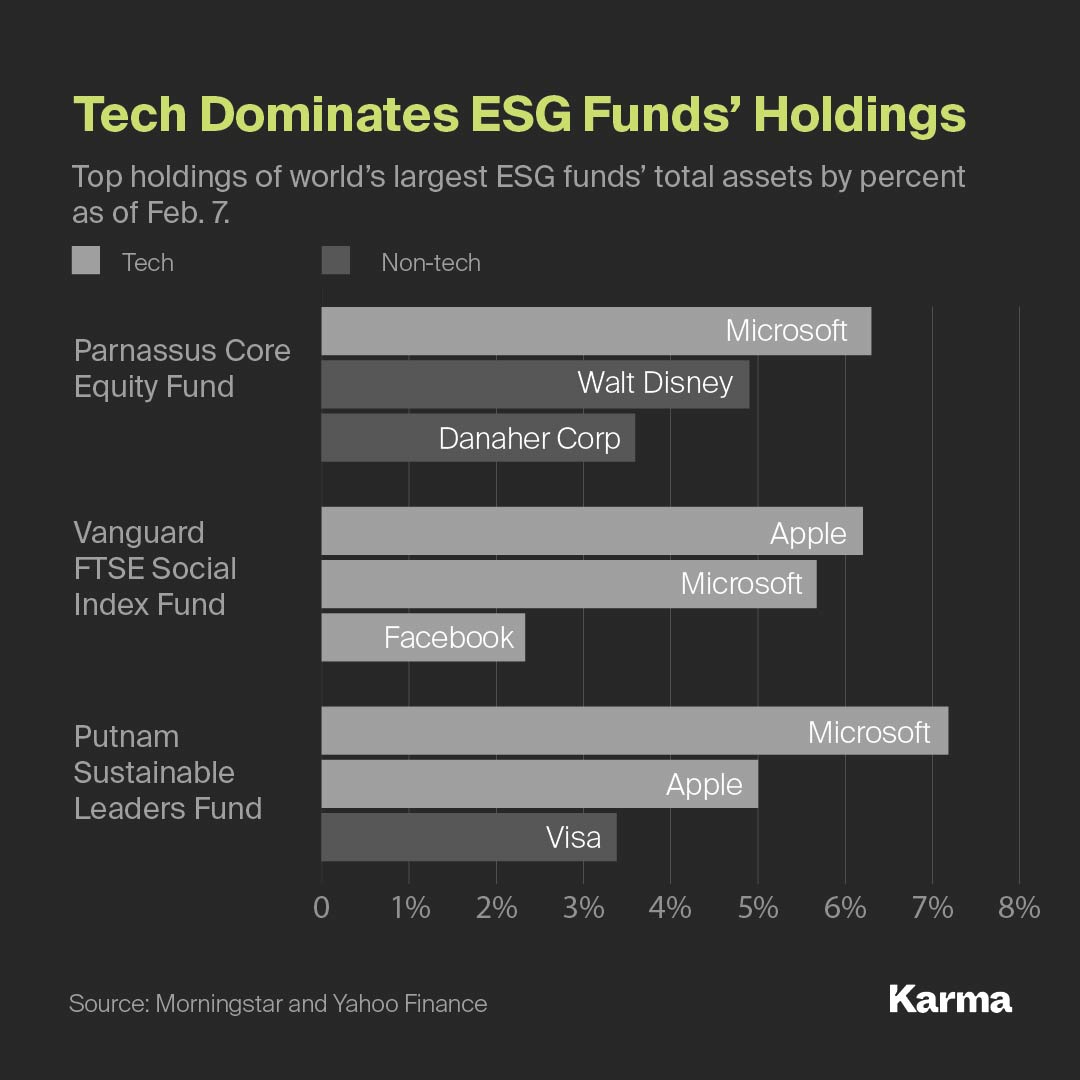

Investors who want their money to go to companies committed to environmental, social or governance principles may be surprised to find tech giants Microsoft, Alphabet and Apple taking up most of the space in their ESG-focused funds.

Those expecting solar panel makers and firms with the most diverse boards to be the biggest recipients of their investment dollars will be disappointed by the results of an analysis by RBC Capital Markets. The three tech giants, along with Visa and Cisco, are the most commonly held S&P 500 shares in managed sustainable equity funds, RBC said. NextEra Energy, the world’s biggest wind and solar farm operator, doesn’t make the list.

“These funds are often invested in stocks that don’t tell the picture of what you might think ESG does,” Mitch Goldberg, president of investment advisory firm ClientFirst Strategy, told the Wall Street Journal.

U.S. funds with a focus on sustainability attracted $20.6 billion of new assets in 2019, according to Morningstar data. This was almost four times more than the previous record flow reached the prior year.

The RBC study highlights a major problem that faces investors who want to back sustainability: No industry-wide rulebook determining what can go into ESG funds exists. Some funds exclude sectors such as oil and gas, while focusing on small companies on the forefront of areas such as clean energy. Many of the bigger funds don’t want to diverge from the broader market so they look a lot like the broader S&P, while avoiding companies that are involved in the worst ESG practices.

Microsoft ranks highly across the board when it comes to ESG yardsticks, while other companies that sustainable funds are pouring money into — such as Facebook and Amazon — don’t rate highly in every benchmark.

Niche funds that focus on specific ESG criteria include the State Street Global Advisors’ SPDR SSGA Gender Diversity Index ETF, which invests in large companies that have at least one woman as a board member or chief executive, and the Invesco Solar ETF that exclusively holds companies in the solar-energy industry.

- European ESG funds attracted a record $131 billion from clients in 2019, Morningstar reported. This left Europe’s sustainable funds holding a substantial $729 billion.

- Funds with “above average” or “high” sustainability ratings performed better than comparable funds with lower sustainability ratings, according to Barron’s fourth annual ranking of ESG investing.

- BlackRock, the world’s largest asset manager, joined the Climate Action 100+ initiative in January after being criticized about its dedication to fighting global warming.