- Global Impact Investing Network survey shows the impact investment market reached $715 billion last year.

- Sector is poised for growth driven by increasing interest from for-profit and philanthropic impact investors, despite the pandemic.

- Investors looking at impact investing due to several factors, including the UN sustainable development goals to address global poverty and inequality.

The Global Impact Investing Network’s survey, released on Thursday, shows a growing impact investment market that reached $715 billion in 2019 and significant opportunities for expansion despite the COVID-19 pandemic.

The tenth edition of the closely watched market report by GIIN estimates that about 1,720 organizations are now involved in managing funds for those who want to make a financial return from investments that also have beneficial social or environmental outcomes.

The outlook for impact investors is good, says Amit Bouri, a co-founder and chief executive officer of the New York-based non-profit.

“We definitely see continued growth in impact investing beyond what’s captured in the survey, “ Bouri told Karma. “There’s an increasing interest from institutional investors in particular, but also high-net-worth individuals, private banks and a variety of other players who are thinking to make more impact investments than we’ve seen in the past couple of years.”

Survey participants raised almost $18 billion last year in new capital and plan to drum up an additional $21.8 billion in 2020, according to the report.

The data was collected between February and April when the world was in the early throes of the pandemic, which may yet affect some of the projections made by the 294 surveyed participant organizations from 46 countries. Most of the respondents are based in the U.S., followed by the U.K., Canada, and the Netherlands, while 5% of the impact investors are based in Sub-Saharan Africa and 3% are headquartered in East Asia.

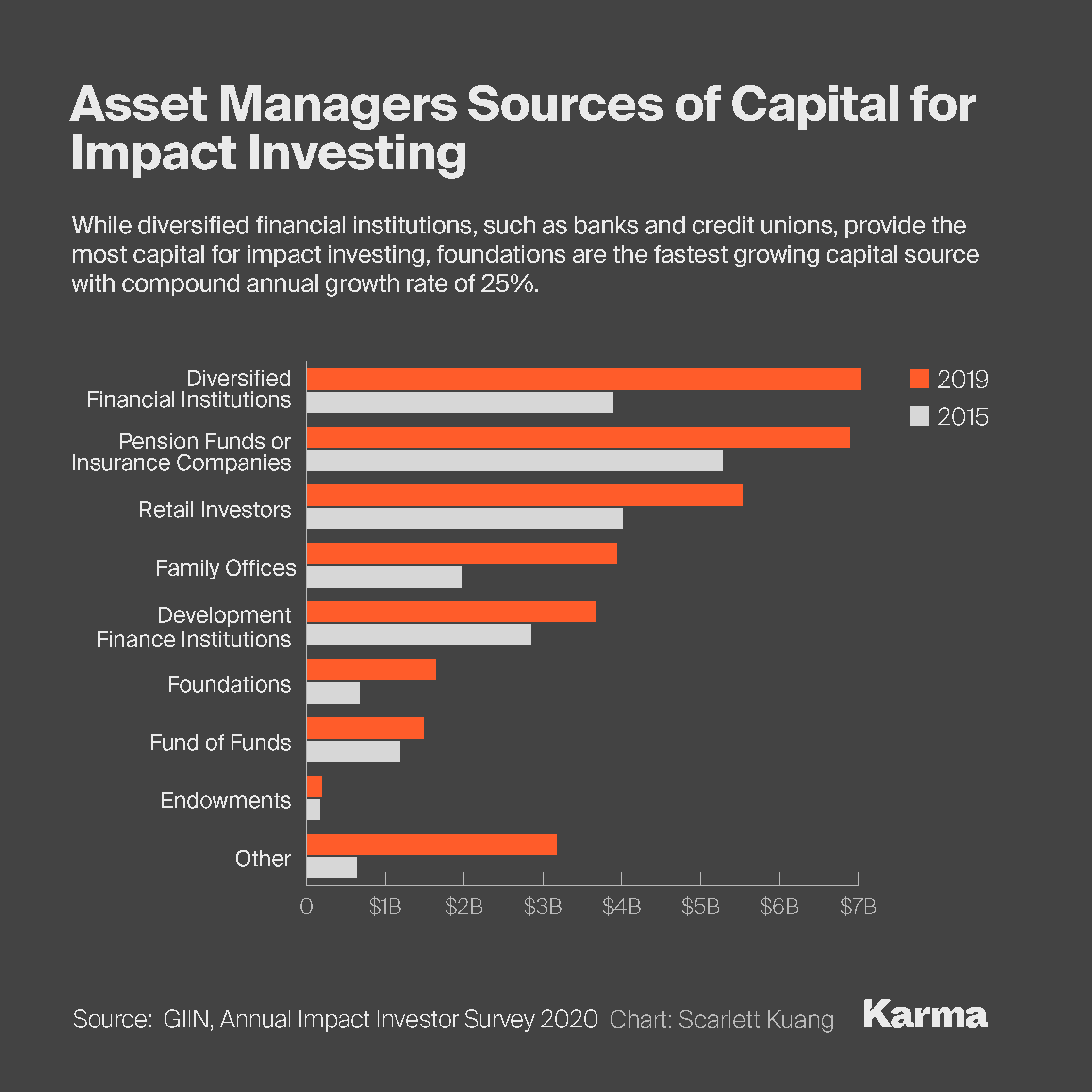

A lot of new philanthropic money has poured into the impact arena with 25% more foundations entering the field between 2015 and last year. Family offices have also ventured into the sector in larger numbers, as have for-profit money managers, says the report.

Investors are being influenced by multiple factors including the United Nations’ 17 sustainable development goals, a roadmap created by the international body to tackle diverse future challenges such as climate change and global poverty reduction by the year 2030.

“It’s clear that more and more individuals are thinking about how their investment capital can play a role in creating a more inclusive and sustainable future for themselves [and] future generations,” Bouri said. “It’s coming out of this crisis we’re in. I actually think there will be more interest in impact investing as we’ve seen the spotlight on many of the inequities in the world.”

The report also outlines different challenges faced by investors who are looking to deploy capital to address a social or environmental need but are not finding an appropriate financial vehicle. About 26% of the surveyed participants said they found a dearth of accessible impact investing fund products. GIIN has been trying to address the issue by holding workshops over several years to bring investors together to develop products. Participants also worried about a lack of a track record for products and financial managers.

Bouri says the problem will be alleviated as the market continues to grow and new funds and managers enter. “With a growing maturity and credibility of the impact sector, investors face increasing opportunities to invest in products that have track records,” he told Karma. “That said, investors would like more business. That’s what you’re seeing here.”

Photo by Dimitry Anikin on Unsplash