- Kenyan borrowers from microlenders can’t stay home to avoid coronavirus, African lender 4G Capital says.

- Africa’s fintech sector — a favorite of investors — poised to accelerate, 4G’s CEO says.

- While Africa has fewer coronavirus cases than elsewhere, the lack of social infrastructure means the continent’s population would find it harder to cope with the impact of social distancing during a pandemic.

While social distancing and working from home are the current Western norm, Africans working to pay off loans from microlenders don’t have those options, according to Mauritius-based lender 4G Capital.

Four out of five Kenyans who borrow from 4G Capital are female, usually selling fast-moving items like agricultural products or consumer goods and living on a day-to-day basis. Refrigerators and kitchens stocked with weeks’ worth of food are rare.

“It’s very hard to see a one-size-fits-all quarantine working everywhere in the world,” Wayne Hennessy-Barrett, founder and CEO of 4G Capital, told Karma from Cape Town. “The governments here in Africa are making the best efforts they can, but there isn’t the social infrastructure to pick up the slack.”

Kenya and other countries in Africa are bracing for the impact of the pandemic, which has hit other continents harder. While there have been almost 720,000 confirmed cases and more than 33,000 deaths attributed to the pandemic worldwide, according to the World Health Organization, Kenya has seen only 38 cases and one death so far. Uganda, where 4G Capital also operates, has reported 33 cases and no deaths.

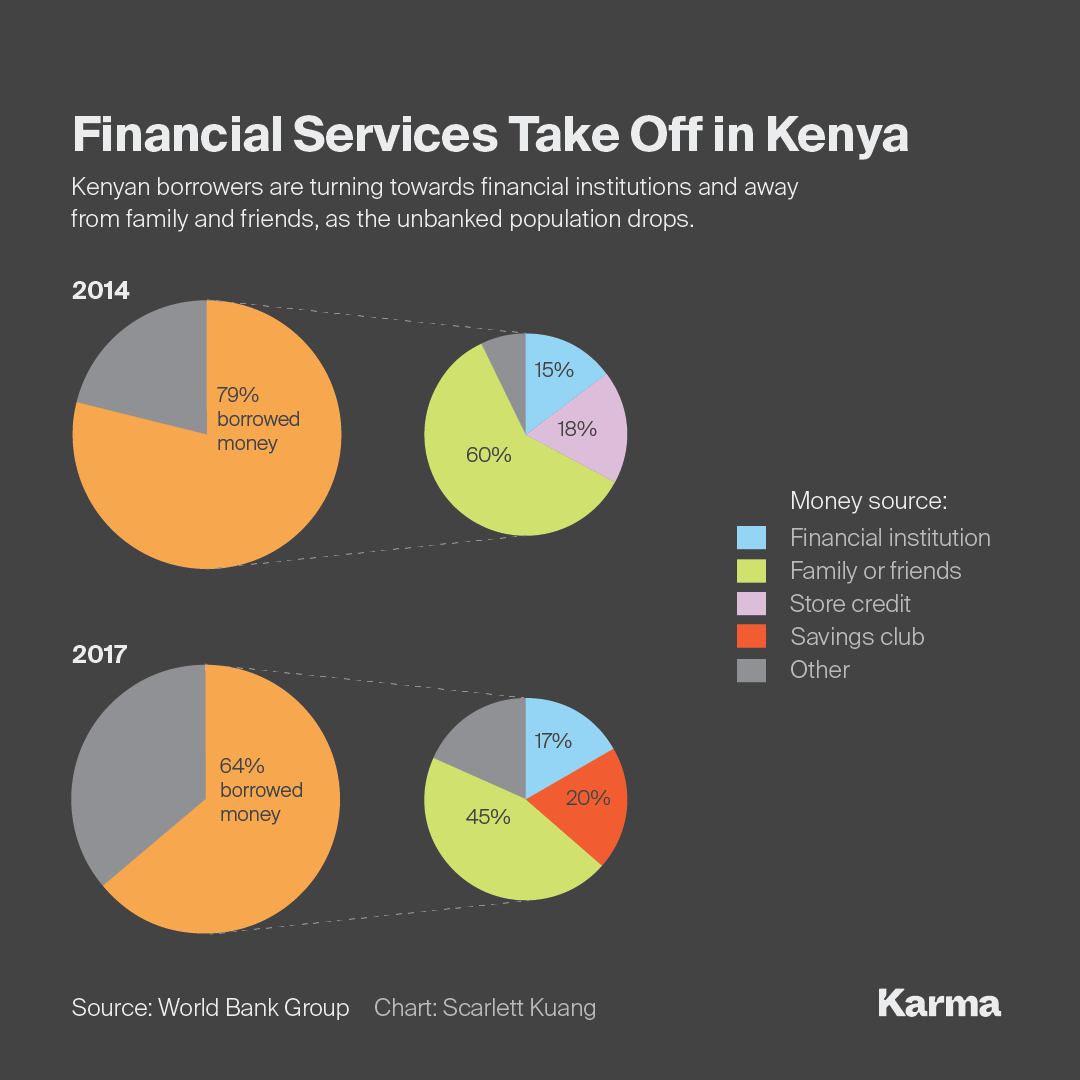

4G Capital is among a number of microlenders including OPay and Tala that are growing quickly in Africa, which has one of the largest percentages of the world’s unbanked population. About 350 million of the world’s 2 billion unbanked people live in sub-Saharan Africa, according to the World Bank. There has been a downside though: Bloomberg Businessweek reported last month that about 2.5 million Kenyans, or 1 in 10 adults, have defaulted on a digital loan.

4G Capital, though, said it has a 92% repayment rate among the 150,000 customers it has served over the years. More than four out of five clients are repeat customers, and clients generally take 20 to 25 days to repay loans that average $50 to $500.

The high repayment rate can be attributed in part to the business training that 4G Capital provides its clients, Hennessy-Barrett said. Another factor that helps is the machine-learning algorithm that evaluates loan applications, he said. 4G Capital also only makes loans to businesses that have a physical location, which also helps ensure that they are stable.

Indeed, Africa has been one of the world’s fastest-growing tech hubs. Venture capitalists spent a record $1.3 billion in the continent last year, more than sixfold from five years ago, WeeTracker’s annual funding report shows.

“I’m tempted to say innovation is going to accelerate,” Hennessy-Barrett said. The pandemic has revealed the “stark reality” of what is needed, which will spur more change.

4G Capital is in the middle of a Series B financing round, which Hennessy-Barrett said has been delayed “a bit” because of the pandemic. But the microlender was able to raise $4 million in debt from a local bank last year, and because of its clients’ high repayment rate “we run a very capital-efficient business.”

The pandemic may hurt raising capital for everyone all around the world, he said, “but people shouldn’t lose sight of what is on the other side of the horizon. Good businesses will continue to need funding.”

As for 4G Capital’s clients in Kenya and Uganda, Hennessy-Barrett sounded cautious but optimistic.

“Africa has a young population” with “extraordinary life force,” he said. “They are very resilient and tough.”