- GameAbove Capital aims at investing in minority- and women-owned businesses with a focus on sustainability.

- Started by CapStone Holdings, GameAbove is deploying $50 million amid the economic downturn that is hurting small and medium-sized companies.

- COVID-19’s spread is exacerbating conditions for female and minority entrepreneurs who have struggled to access capital in the past.

A Florida-based family office backed the creation of GameAbove Capital, a venture capital firm aimed at investing in minority- and women-owned businesses with a focus on sustainability, amid a pandemic and economic downturn.

CapStone Holdings in late May seeded Game Above Capital with $50 million to invest in female-run and minority-owned enterprises through joint ventures, equity stakes or outright acquisitions. The global coronavirus outbreak served as a catalyst for the fund aimed at injecting badly needed liquidity into the economy, says Keith J. Stone, CapStone Holdings founder and chairman.

“The pandemic further exacerbates the issue of access to capital,” Stone told Karma in a written statement. “We believe we’re providing some level of stability during these uncertain times.”

The pandemic has hurt the U.S. economy and caused more than 40 million people to file for unemployment benefits since mid-March, according to official data. Women and minority entrepreneurs were especially hard hit. In the wake of the outbreak, around 90% of such businesses were shut out from accessing the government’s Paycheck Protection Program, CBS News reported.

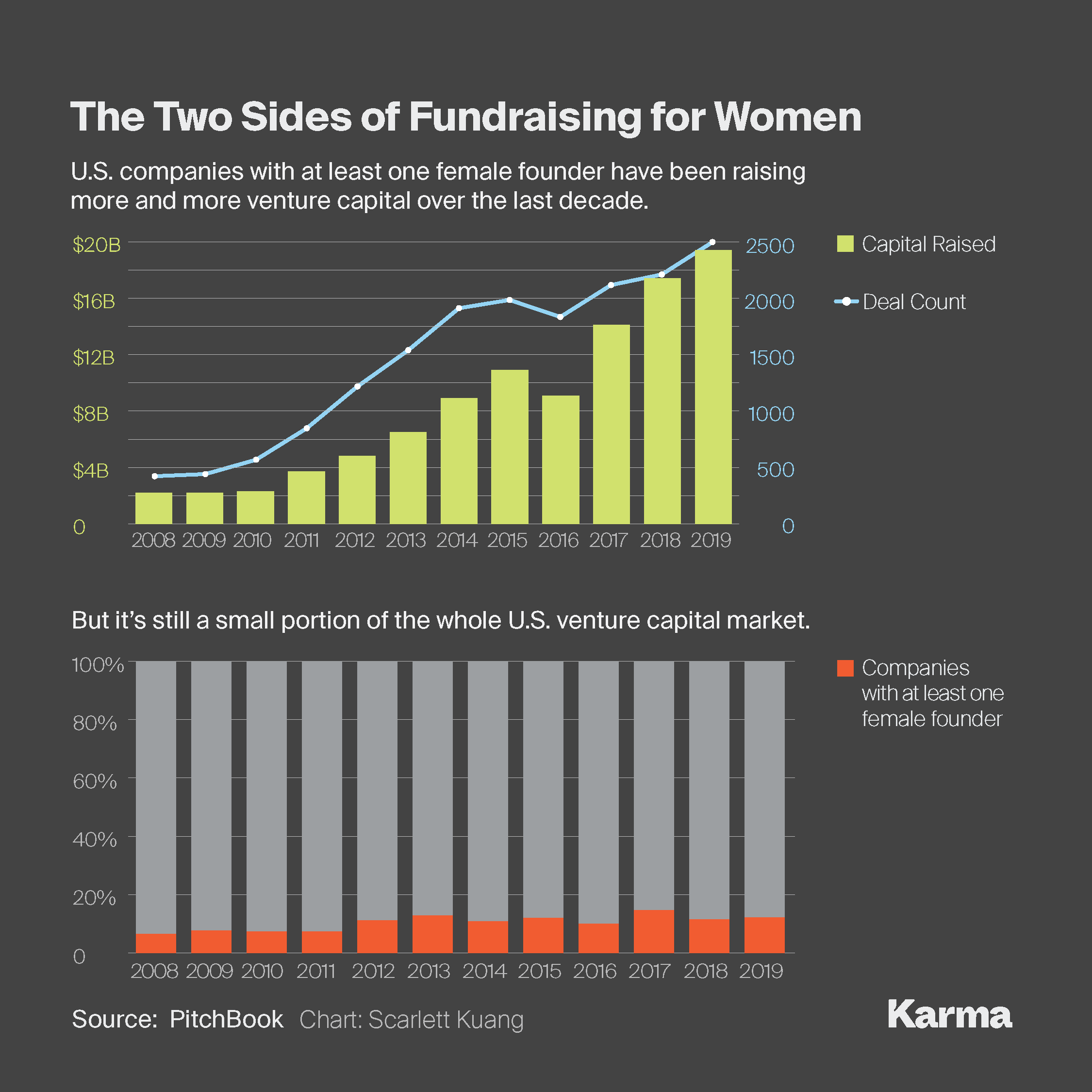

Those same businesses have historically struggled to attract growth capital. The venture sector directed about 16% of almost $83 billion to companies with at least one female founder and only 2.5% of money flows went to companies exclusively run by women in 2017, according to a report from the Center for American Entrepreneurship.

Stone wrote that with the fund, CapStone hopes to “fill a significant gap when it comes to a lack of capital for women and minority entrepreneurs.”

The team behind GameAbove Capital hopes to change the underinvestment trend by engaging with cash-starved companies. The minimum transaction for each investment deal will be $3 million and the firm will zero in on companies that focus on environmental and social sectors, such as clean water ventures, transportation, education and worker development.

The venture firm benefits from the more than three decades of financing expertise of its parent company CapStone Holdings, a family office entity and holding company that invests in areas including financial technology startups and real estate.

“The good news is that since we announced this fund, we are receiving some great ideas from women-owned and minority-owned companies,” Stone wrote.

CapStone Holdings invests in real estate among other assets. An earlier version of this story incorrectly said GameAbove Capital has invested in real estate since it was launched.