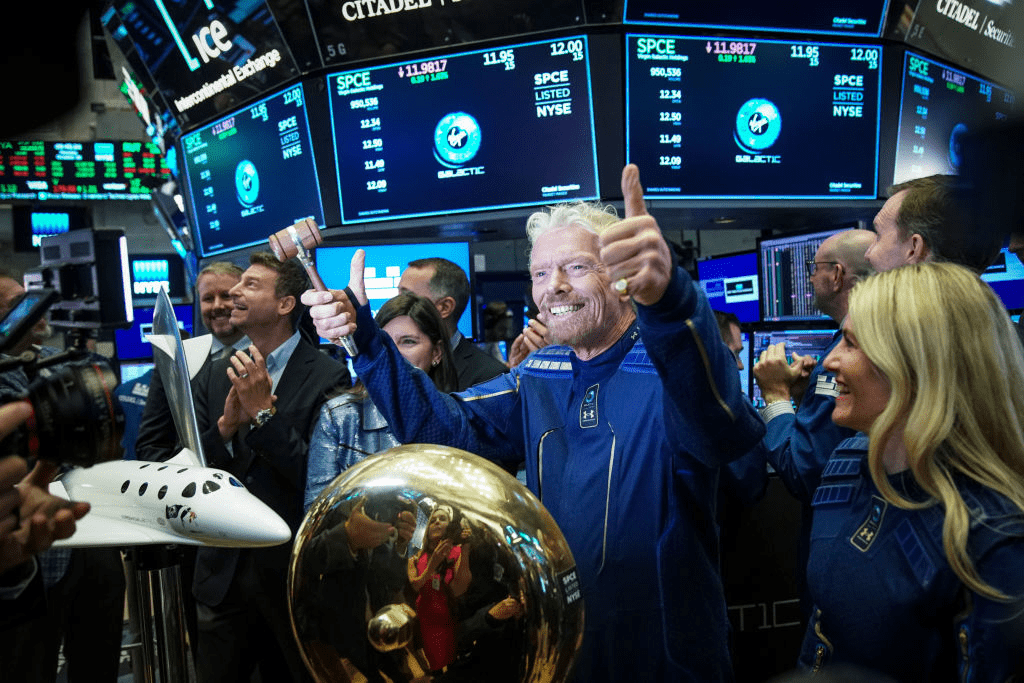

Virgin Galactic’s shares briefly scraped the stratosphere before returning to earth in the space tourism company’s stock market debut.

The world’s first publicly traded space tourism company closed down four cents at $11.75, valuing the company at $969.1 million. The stock soared as much as 9.7%, to $12.93, in its debut on the New York Stock Exchange. The shares, traded as SPCE, slipped as gains in transportation stocks failed to match those in broader markets.

Company officials had exulted earlier in the day at the debut. “Anyone can invest in a human spaceflight company,” Chief Executive Officer George Whitesides said in a statement.

Still, the debut signals a milestone in private space travel. Virgin Galactic has been a pioneer, with technologies such as reusable rockets and efficient launch methods, boosting the prospects for commercial space travel as a viable industry. UBS forecasts that space as a business will triple in value to almost a trillion dollars over the next two decades, with companies such as Elon Musk’s SpaceX and Blue Origin also competing in the sector.

Virgin Galactic began trading on Monday after it completed a merger with Social Capital Hedosophia, a venture capital vehicle listed on the NYSE. Run by early Facebook executive Chamath Palihapitiya. Social Capital took a 49%t stake in Virgin Galactic under the tie-up, which valued the company at about $1.5 billion and left Branson with a controlling stake. Social Capital’s shares rose 11% on Friday after the merger was approved.

Virgin Galactic plans to take paying customers onboard next year. Clients — who include Justin Bieber and Leonard DiCaprio, according to Bloomberg — will pay about $250,000 to be flown to the edge of space, where they’ll enjoy several minutes of weightlessness before descending to Earth and touching down as in a conventional airplane. The firm says it has collected reservations from more than 600 passengers in 60 countries, providing more than $120 million in potential revenue.

The company decided to list after trying to raise money privately, including holding talks with Saudi Arabia that were called off after the murder last year of journalist Jamal Khashoggi. The listing gave Virgin Galactic primary proceeds of more that $450 million.

- Branson’s company manufactures its vessels in Mojave, California, through its aerospace development subsidiary, The Spaceship Company, with commercial operations centered at Spaceport America in New Mexico.

- Elon Musk’s SpaceX made headlines last year when it announced Japanese billionaire Yusaku Maezawa would be its first space tourist once the company’s Big Falcon Rocket is developed. Maezawa has chartered a slingshot trip around the moon for as soon as 2023.